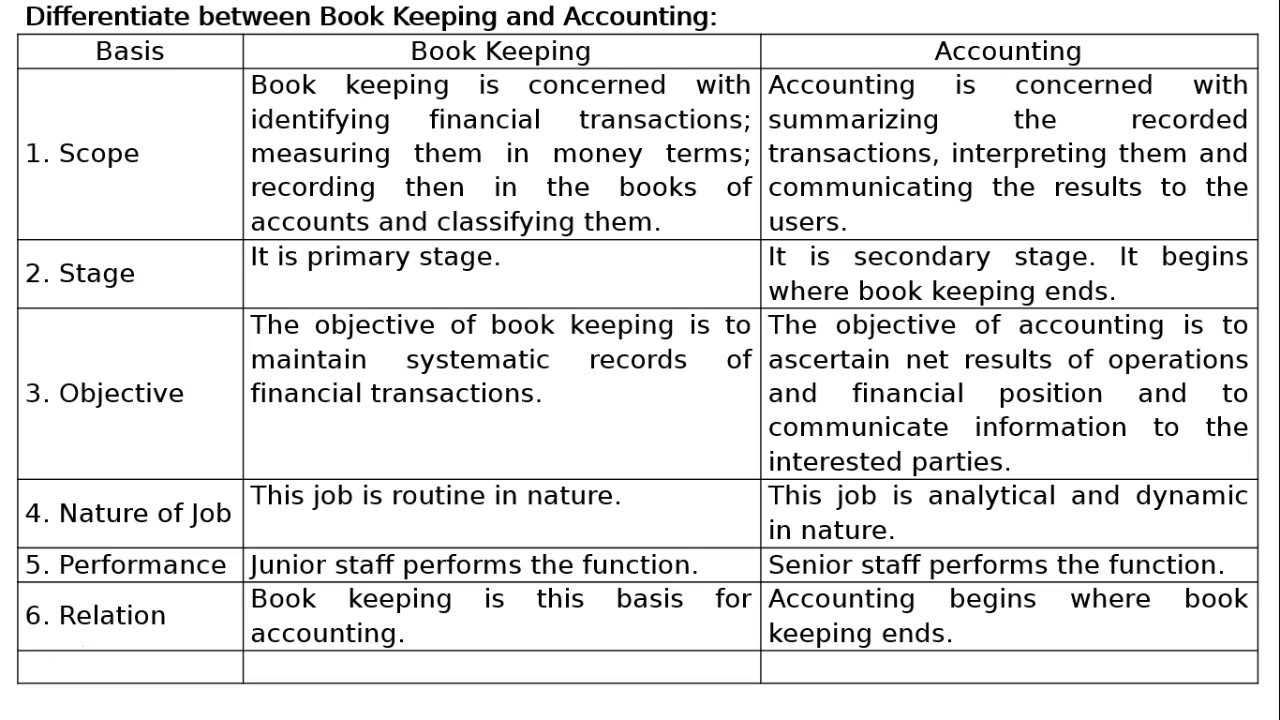

Internally conducted audits ensure that financial records are accurately and ethically recorded according to industry standards. Both bookkeepers and accountants can prepare tax returns, but only accountants can perform routine financial audits. While accounting can include bookkeeping tasks like recording daily transactions into the general ledger, bookkeeping does not include accounting responsibilities such as analyzing your company’s financial health.

They don’t take an accountancy exam and fulfill the licensing requirements of a CPA. To be clearan enrolled agent isn’t a CPA. They represent their clients in an audit and in some cases, tax court too.

DIFFERENCE BETWEEN BOOKKEEPER AND CPA PROFESSIONAL

Bookkeepers focus on day-to-day financial recording, while accountants give a big-picture view of a company’s finances. A tax preparer is an enrolled agent, or a financial professional licensed by the IRS to file taxes on behalf of others. Bookkeeping entails the following tasks: Debits and credits must be posted. Bookkeeping is the practice of documenting daily transactions regularly, and it is an essential part of obtaining the financial information required to manage a successful business. Though many confuse the two roles, bookkeepers and accountants have distinct differences. Difference between bookkeeping and accounting Bookkeeping Process. How Are Accounting and Bookkeeping Similar and Different? Security monitoring and financial risk assessment Knowledge of ethical financial practices, portfolio management, and investment analysisĢ years of relevant work experience and must pass exams Maintain knowledge of standard accounting practices and tax lawsĤ years of relevant work experience and must pass a 3-part exam Meet state requirements, pass Uniform CPA exam, and meet continuing education requirements The minimum credential needed to practice accounting There are other certifications that accountants might have, including Chartered Financial Analyst (CFA) and Certified Internal Auditor (CIA). To use the title of CPA, an accountant must pass the CPA exam. In general, the bookkeepers role is to record transactions.

DIFFERENCE BETWEEN BOOKKEEPER AND CPA SOFTWARE

Many accountants use accounting software like QuickBooks to automate accounting tasks and ensure the accuracy of financial data.Īccountants typically have a bachelor’s degree in accounting and are also registered Certified Public Accountants (CPA). Accountants and bookkeepers sometimes perform the same work, but they have a different skill set. Maintain up-to-date knowledge of tax law.Make recommendations based on the reports.Use financial statements to create reports.What is Accounting?Īccounting is the compilation and interpretation of financial data to help companies make informed business decisions. There are optional licenses available for bookkeepers through accreditors like the American Institute of Professional Bookkeepers (AIPB) and the National Association of Certified Public Bookkeepers (NACPB). Ensure the accuracy of data and close books for tax timeīecoming a bookkeeper does not require any formal education, but it does require knowledge of finances and accounting.Prepare financial statements, including income statements and balance sheet.Record financial transactions in the general ledger.Does My Company Need a Bookkeeper or Accountant?īookkeeping is the recording and organization of financial data.

How Are Accounting and Bookkeeping Similar and Different?.Bookkeepers who excel at their jobs are also sometimes promoted to accounting positions, even if they lack the level of education the company typically prefers. In fact, many aspiring accountants work as bookkeepers to get a foot in the door while still in school. You can become a bookkeeper right out of high school if you prove you are good with numbers and have strong attention to detail. Accounting often requires more education than becoming a bookkeeper, where most accountants hold undergraduate or graduate degrees or even MBAs in accounting, economics, or finance.Bookkeepers line up all the small pieces of a company's financial records, and accountants view and arrange those pieces.Accountants traditionally acquire their CPA certification and a master's degree.Bookkeeping is where accountants generally start their careers as the barriers to entry are lower and pay is decent.The job titles bookkeeper and accountant are used interchangeably but are distinct and have different requirements.

0 kommentar(er)

0 kommentar(er)